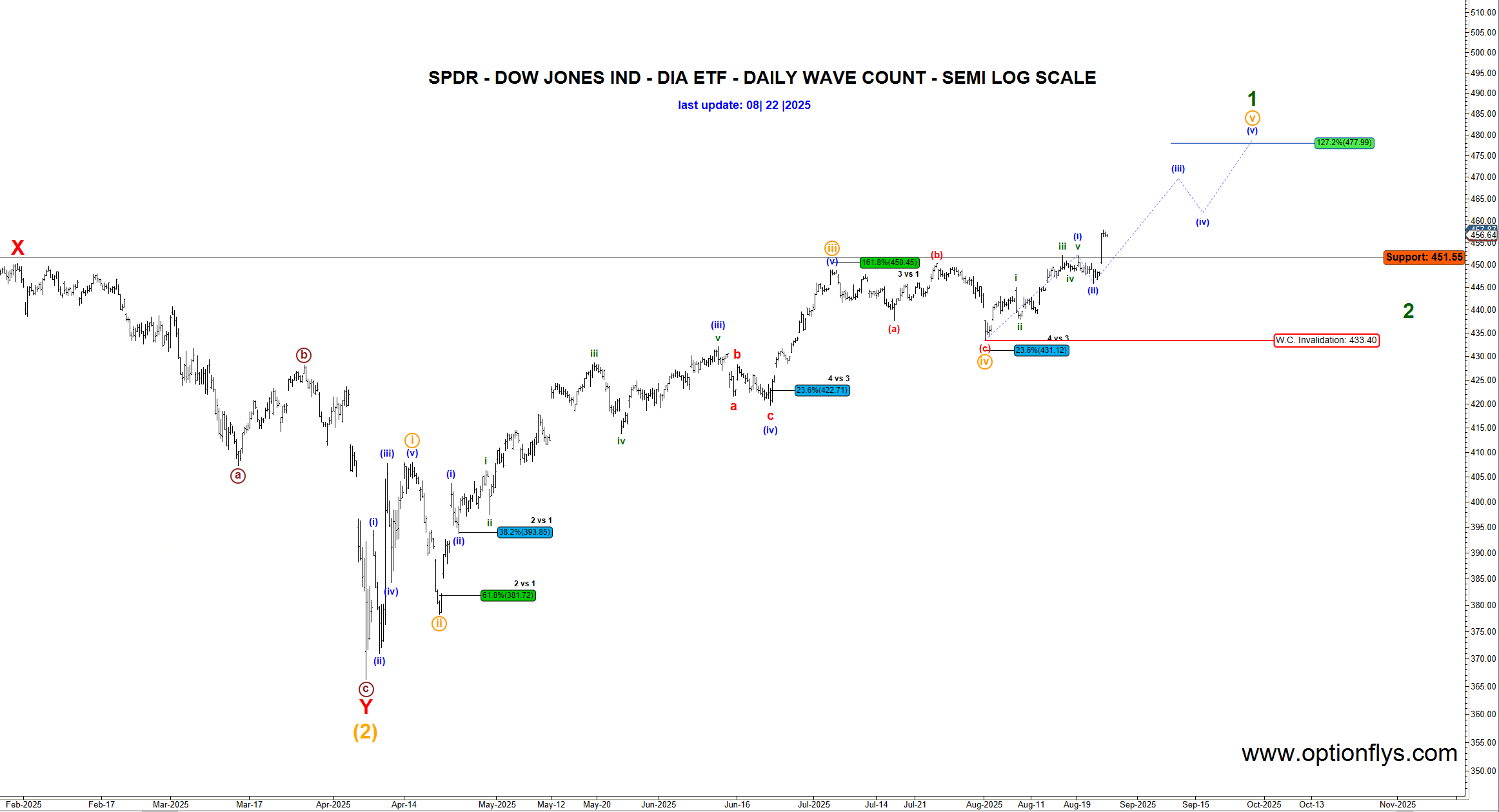

SPX Cash Index

? SPX Cash Index – Daily Wave Count (Updated Aug 23, 2025)

The S&P 500 continues to advance within the larger primary wave structure, now pressing into the resistance zone near 6500–6550. Wave 5 is maturing, and price action is testing the 200% Fibonacci extension at 6504.41.

If this zone holds, we may see a corrective pullback into the Fibonacci retracement zone (FRZ) at 6209–6505 before the broader trend resumes. Key support levels remain at 6147 and the April low at 4835.

? Key Levels

-

Resistance Zone: 6500–6550

-

FRZ Support: 6209–6505

-

Invalidation: Below 6147

-

Major Support: 4818

This Elliott Wave structure highlights the importance of discipline at key inflection zones. Options traders can position with defined-risk structures such as butterflies or calendars into resistance, allowing for high reward-to-risk setups if wave 4 develops.

At OptionFlys.com, we combine Elliott Wave counts, Fibonacci confluence, and our proprietary buy/sell signal system to deliver world-class trade setups. Stay disciplined, trust the structure, and let probabilities play out.